ACH bank transfers are hands down the best, most cost effective payment option for recurring donations and large, one-time gifts. The only hurdle to ACH giving is bank verification.

By improving the bank verification process, churches can spend less money on processing fees from credit card payments—and those processing fees can really add up!

That’s why we switched to Stripe Financial Connections for faster, safer bank verification for donors.

By encouraging congregants to use a safer, cheaper option, churches can put more money toward other ministry needs—payroll, missions, or just keeping the lights on.

Making the Switch to Stripe for Bank Account Verification

ACH transfer is already a safe, fast, and reliable way to transfer donations, and Stripe Financial Connections is an opportunity to improve the experience for churches and congregants.

So here are four ways Stripe Financial Connections helps us do that:

1. Improved Security in Bank Authorization Process

Stripe Financial Connections uses open authentication (OAuth) as the primary bank verification method. It’s a widely used protocol in which a third-party verification provider initiates a login window that is provided by the donor’s bank. The donor then logs into their account, affirms they’re providing access to this third-party service, and that’s it.

When a bank doesn’t provide the ability to use OAuth, verification providers turn to a method called credential brokering, which involves asking for your donor’s online banking credentials and logging in on their behalf to complete account verification. It’s an undesirable strategy because no one likes handing out their bank login to a third-party. People like logging into their bank at their bank website.

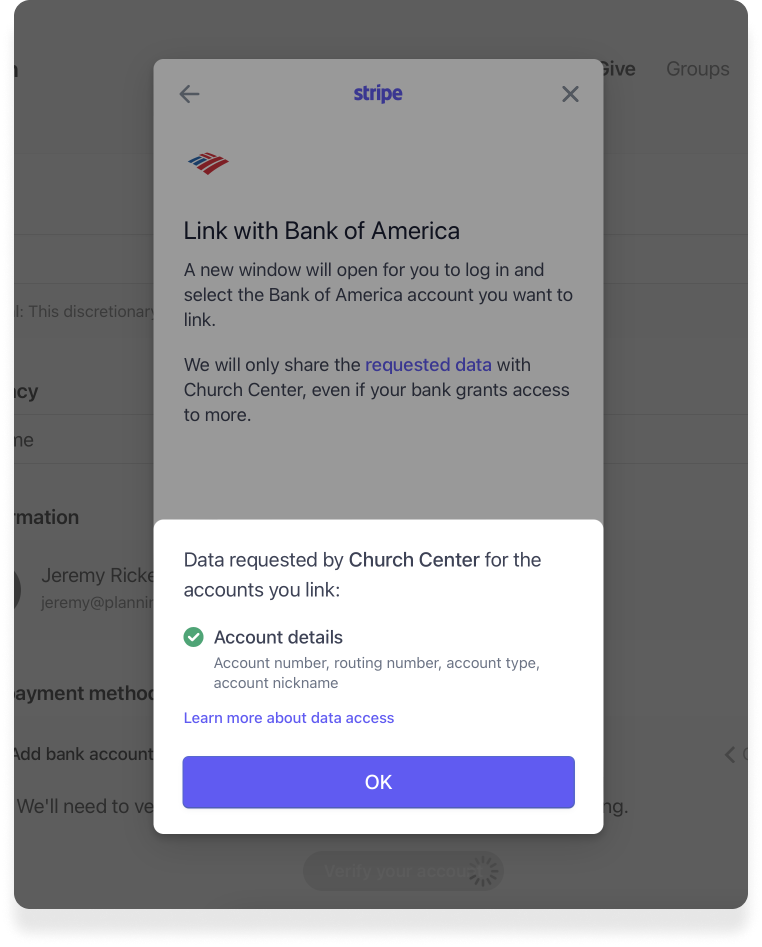

Stripe Financial Connections uses the OAuth process by default. This way donors are more comfortable with the verification process and have more control over what information is shared. It uses credential brokering only as a fallback.

2. Better Fraud Protection

Bank authentication systems can be a target for scammers, and many rely on a tactic called “micro-deposit harvesting.” A scammer connects a bank account, initiates a manual micro-deposit verification which makes two small deposits into their account, and then disconnects before their action is detected.

Stripe Financial Connections mitigates this threat by sending a single $0.01 micro-deposit to a donor’s bank account with a unique, 6-digit code appended to the church’s name. Donors then verify the code instead of the micro-deposit amounts. Stripe’s central fraud system does an incredible job detecting and mitigating all kinds of payment fraud happening on its vast payment network.

3. More Transparency for Data Access

To verify account ownership and set up ACH giving, all we need is the account number, routing number, account type, and the account nickname. Nothing else. And a church’s donors can see exactly what kind of data Stripe Financial Connections is requesting, too. Nothing is unnecessary, and nothing is hidden.

4. All-Around Improved Data Security

Because churches trust us with very personal and private information, we do everything we can to keep their data safe with secure practices, procedures, and systems. This also means working with providers who most align with our values and are experts in our common goals. Stripe Financial Connections does both.

Stripe doesn’t traffic in user data, push ads, or require unnecessary data from our customers. They’re in the business of payment processing and aim to do it in the most secure, streamlined, and reliable way possible. So when Stripe released an option for bank verification, we saw it as an opportunity to bring their expertise to this piece of the payment process.

$0.05 Fee Increase for ACH donations with the Transition to Stripe Financial Connections

The transition to Stripe’s bank verification services does require another shift: on October 31, 2022, the price of ACH bank donations will increase from $0.25 to $0.30 per transaction. There’s still no additional transaction % fee.

Raising costs is not something we are quick to do, and Planning Center does not make any money off of processing fees. This fee increase is going directly towards Stripe Financial Connections, something we firmly believe is well worth the price bump for our churches.

Immediately after upgrading our current customers to Stripe Financial Connections, we noted a much higher percentage of donors opting into instant bank verification, which means they’re able to set up their ACH giving on the spot. The more donors that choose ACH over credit card giving, the better, so you can save on processing fees!

We love our churches and are committed to them having the best and safest experience possible. We believe Stripe Financial Connections will provide just that.

💛Team Giving

:quality(80))