Late last year we quietly released an improvement to how donors verify their bank accounts for ACH bank transfer donations—the most cost-efficient way to give at just $0.25 per donation.

With this update, we expanded our support for instant account verification from roughly 4,800 banks and credit unions to over 11,100 banking institutions across the US.

As a result, more of your donors can connect their bank to Planning Center Giving to give via ACH instead of their credit card—saving you money in processing fees.

How Instant Account Verification Works

Unlike credit and debit cards, bank accounts have a unique requirement that the giver must verify they own the bank account before they can start transferring money out of the account.

Traditional verification is done using two small bank deposits, the amounts of which the donor must verify before they use the account for ACH transfers. The process is clunky, takes multiple days to complete, and interrupts the flow of giving. A shocking number of donors get hung up in the verification process and never actually connect their account.

To solve this problem, Giving was an early adopter of Plaid, a service that offers instant account verification using the account holder’s online banking credentials. It’s fast, secure, convenient, and it’s free to you as a Stripe customer and as a Planning Center customer.

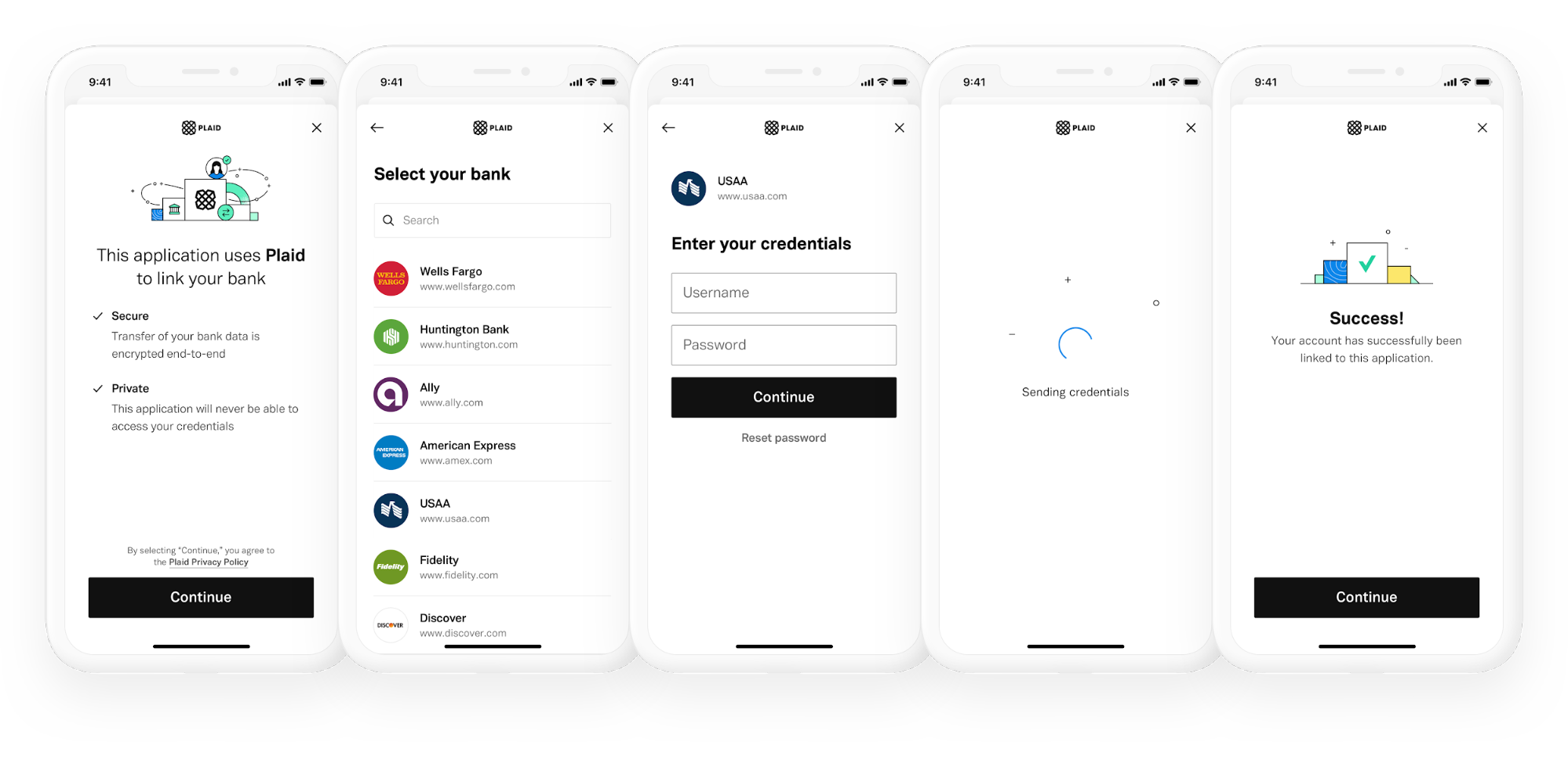

If you're unfamiliar with Plaid's instant verification process, here it is in action on the mobile app:

If a donor’s bank doesn’t allow instant verification, Plaid will fallback to _auto verification—_which involves two micro-deposits automatically verified without the donors needing to do anything. And in the rare case that neither instant verification nor auto verification are available, Plaid will use the old micro-deposit method as a last resort.

The Point: Saving on Fees

So what does this mean for your church? Well, when it's easy for your donors to connect their bank account, they're more likely to use their bank account instead of a credit card to give. That means your church saves on processing fees.

Currently, the cost of processing fees for credit and debit cards in the US is 2.15% + $0.30 per transaction. ACH transfers cost a flat $0.25. So, if a donor sets up a weekly $500 donation, it works out like this:

Credit Card: $10.75 (2.15% of $500) + $0.30 x 52 weeks = $574.60 in fees annually.

ACH Bank Transfer: $0.25 x 52 weeks = $12.50 in fees annually.

Remember, Planning Center doesn't make a penny from processing fees. So, we’re always looking for ways to reduce your fees while still providing a high level of service, reliability, and functionality for you and your donors.

The Results: Churches Already Saving Money

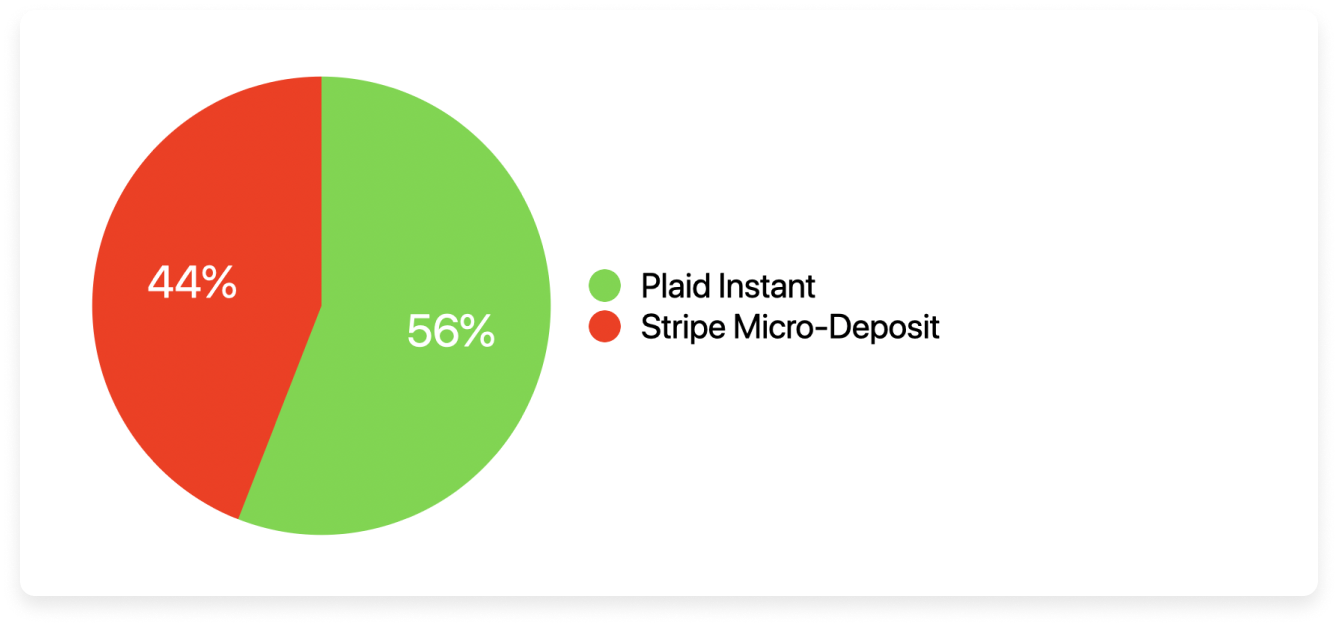

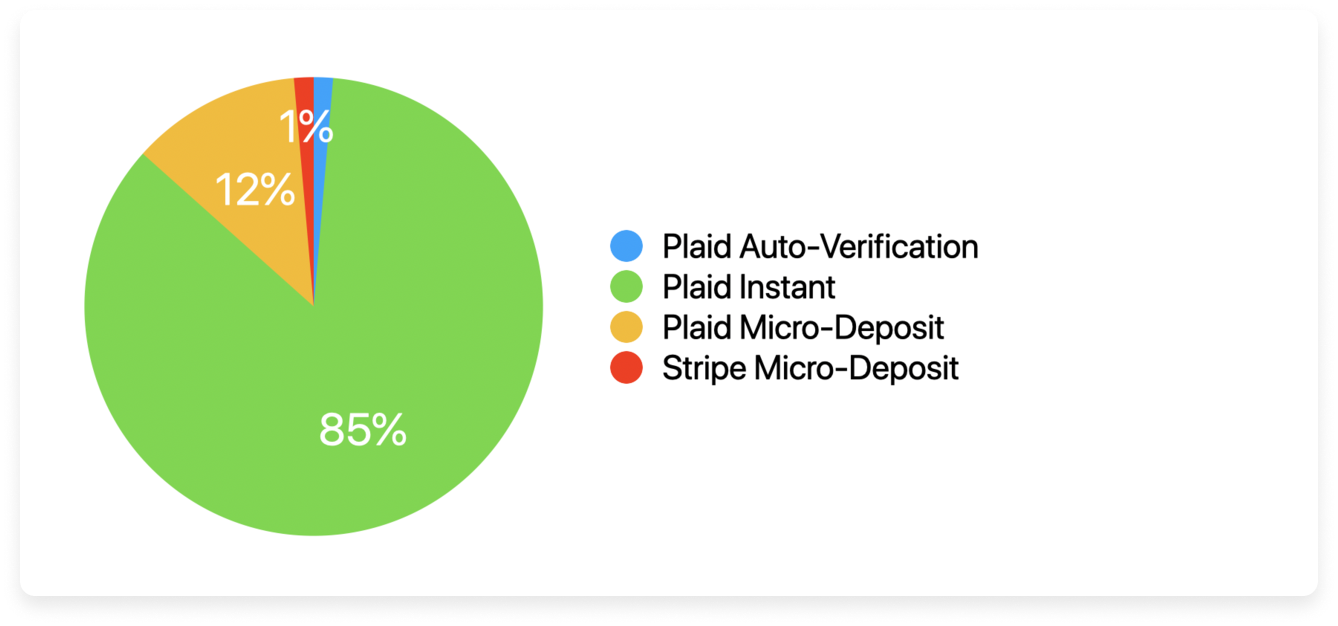

We looked at donor trends for 7 days before and after this change, and we like what we're seeing. The data below represents thousands of bank account verifications.

Typical week before this change: Only 56% of donors instantly verified their bank accounts over a 7 day period. The other 44% had to wait a few days for the Stripe micro-deposits to show up before revisiting their donor account to complete the process.

First week after this change: 85% of donors who verified their bank accounts did so instantly! The rest had to resort to micro-deposit verification, but they were able to either complete that process within one day because of Plaid's same-day micro-deposits or see their accounts automatically verified due to Plaid's auto verification system.

The red sliver of Stripe micro-deposits you see are donors who were in the middle of completing their manual account verification when we rolled out this change a few weeks ago.

Onward!

We're thrilled with these initial results. Along with introducing new features (like permissions), it's important to us that the core functionality of Giving is always improving.

We want the experience of quickly and easily set up a bank account for online giving to be seamless and top-notch, and we believe this is a big step in that direction.

Team Giving

:quality(80))